Inclusive finance

On this page you find information on:

- Why inclusive finance?

- Instruments for inclusive finance

- Lowering finance risks in agriculture

- Geodata for Inclusive Finance and Food (G4IFF, NpM)

- Space for inclusive finance (UK Space Agency, IPP programme)

Why inclusive finance?

In light of a growing demand for food, smallholder farmers are crucial in supplying the world with sufficient food. One way to achieve this growing demand for food is to provide smallholder farmers with information services so they can make informed decisions. This was the starting base of G4AW Facility in 2013. Over time it has become apparent that only providing services aimed at agricultural advice is not sufficient when smallholder farmers do not have enough resources to, for example, buy necessary inputs such as seeds and fertilizers. In such cases, access to affordable and appropriate financial services is key for smallholder farmers. More generally: “Access to financial services offers people the possibility to improve their living standards, which in turn reduces inequality. Inclusive finance can result in poverty alleviation, job creation, food security, gender equality, and equitable growth” [8].

There has been an increase of microfinance service provision but most notably, there has been a development from access to microfinance to inclusive finance in recent years. Inclusive finance is often defined as the ability to provide access to useful and appropriate financial products and services such as transactions, payments, savings, credit, insurance, pensions, etc. at an affordable cost. [7]

Instruments for inclusive finance

Financial institutions often see agriculture lending as risky and costly and do not easily lend to smallholder farmers as they are considered non-bankable. The NpM report (2018 - [4]) distinguishes a range of instruments for inclusive finance:

- Crop-based index insurance

- Crop-specific microfinance

- Finance by chain or actors (embedded)

- Financing producer organisation activities (like processing)

- Microfinance to individual farmers

- Mobile banking

- Solidarity group lending

- Warehouse receipts

- Wholesale finance through the producer organisation

Lowering finance risks in agriculture

There are studies that show that the lack of understanding of agriculture and its associated risks at the financial institutions level leads to an overestimation of risks and costs [3]. Recent developments, however, show that technological applications can help financial service providers (FSPs) reach out to rural areas with lower transaction and monitoring costs while increasing their knowledge and understanding about agricultural production, seasonal cropping patterns, and eventually the associated risk of providing services to smallholder farmers. [7]

Below we refer to two initiatives that believe in the use of satellite data and geo-ict for lowering (financial) risks in agriculture.

Geodata for Inclusive Finance and Food (G4IFF, NpM)

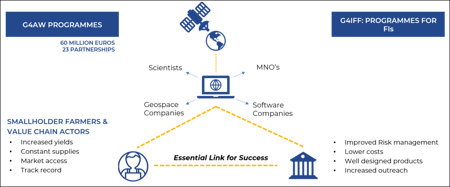

The Netherlands Space Office started a strategic cooperation in 2016 with the Dutch Platform for Inclusive Finance. The vision was that geodata, as being used in G4AW projects for advisory and insurance services, could also be used in inclusive finance. In February 2017 a conference was held to bring the various actors together so that financial institutions could explain their needs and service providers could present their existing products and services. The conference was concluded successful and it was agreed to stimulate innovation via a challenge.

In 2018-2019 NpM, with funding from several of its members and NSO, organized the Geodata for Inclusive Finance and Food (G4IFF) challenge. The goal of the challenge was to, via pilot projects, to demonstrate concept-of-proof of financial services for smallholder farmers by using geodata based information. Critical elements in the challenge were reducing risks for financial institutions and providing affordable credits to smallholder farmers. NpM will publish an evaluation of three G4IFF and three G4AW projects with inclusive service provision in Q1 2021.

For more information on G4IFF please visit: https://www.inclusivefinanceplatform.nl/geodata-for-inclusive-finance-and-food/.

For an overview of Geodata and ICT technologies that are currently being used to boost production, market access and access to finance for smallholder farmers visit: http://www.inclusivefinanceplatform.nl/ict-map

Source: NpM

Space for inclusive finance (UK Space Agency, IPP programme)

UK Space Agency is operating the IPP programme in which several projects aimed at inclusive finance and insurance are financially supported. The use of satellite data is here also seen as a means to lower risks and to lower costs of operations.

“There are numerous challenges to the delivery of financial products to remote populations in developing countries. These range from limited customer data to constrained business models, the accessibility and affordability of products, and low consumer trust in formal financial services. Space based technology can provide new types of information, which can form part of the solution to a number of these challenges. In particular, it can help address data limitations and enable financial service providers to assess risk, monitor their portfolio and verify claims. The direct impact of using space technology will be via the finance providers, through increasing their customer base, reducing operational costs, improving risk management and in the case of index insurance, reducing basis risk. These effects at the financial provider level can be passed on to impact the customer, by increasing access to affordable financial products and improving trust in financial services.”[6]

Recommended publications:

For more information on any of the topics described above please find below a selection of reports.

- NpM: Summary Report: Geodata for Inclusive Finance and Food

- NpM: Geodata for Inclusive Finance & Food: Inventory of Technology

- NpM: Geodata and ICT Solutions for Inclusive Finance and Food Security: Innovative Developments – An overview

- NpM: Full Report: Finance for Smallholders: Opportunities for risk management by linking financial institutions and producer organisation

- NpM: Reach, Benefit and empower women with financial services

- UK Space Agency International Partnership Programme: Space for Finance in Developing Countries

- World Bank: Financial Inclusion

- https://www.inclusivefinanceplatform.nl/about-us/

- Mercy Corps; Ventures: Insurtech: series on crop micro-insurance

- GSMA: Agri DFS: Emerging business models to support the financial inclusion of smallholder farmers