MUIIS

Satellite Data Application for Ugandan Farmers Moves from Project to Business Phase

> Download the MUIIS project closure flyer

The aim of the Market-led User-owned ICT4AG-enabled Information Service (MUIIS) was to establish a demand-driven, market-led, and user-owned approach to provide satellite based information services related to weather forecasting, crop management and insurance to farmers in Uganda. The value proposition focusses on bundled mobile services and index-based crop insurance. Subscribers pay for this information via the mobile network operator. The service builds on already existing customer relationships and previous experiences and makes use of an existing network of agents on the ground. The crops covered are maize, beans, soy and sesame. The main actors in the MUIIS consortium were: CTA (an international institute specialised in agricultural development, now part of Wageningen University), Ensibuuko (a Ugandan fintech company) and eLEAF (a provider of satellite-based insurance).

Provided services

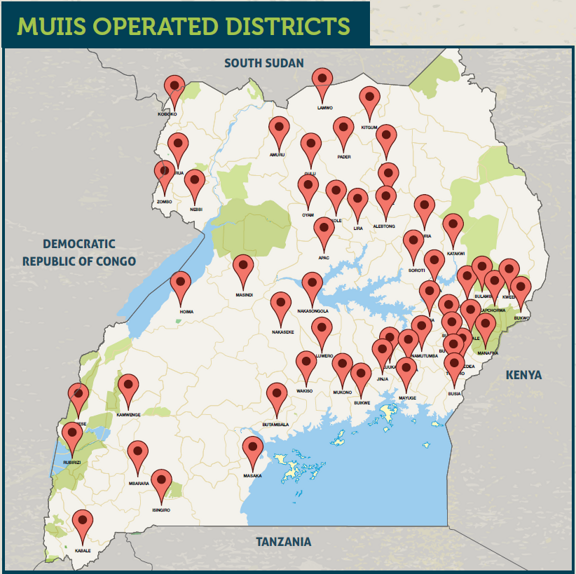

MUIIS provides advisory and insurance services in the form of agricultural input loans, crop index insurance, crop management advice, advice on good agricultural practices, and weather information. To do this effectively more than 270,000 farmers were profiled with detailed information on each farmer, including the GPS coordinates of their fields. Agents were contracted, the so-called MUIIS Service Agents (MSAs), who were trained and involved in marketing and selling of the services to the farmers. The farmers received the advice through SMS-text messages and the MSAs. MUIIS developed a database and dashboard for service delivery, which has been revamped, cleaned and decentralised for access directly by the farmer organisations and/or cooperatives and other clients, based on feedback from the field. Crop insurance is perceived as the most valuable service. This is the only service of which Earth observation is an essential component. The MUIIS insurance service uses the same technology and method as the G4AW SUM Africa project.

Agricultural fields in Uganda seen from space (image: NASA)

Business model

Revenue is generated by charging a percentage of the loans that farmers take, charging for services bought by Savings and Credit Cooperative Organisations (SACCOs) and by recovering the government subsidy on insurance. Although the number of farmers who have taken out subscriptions is gradually increasing, it remained well below the profit threshold. The project therefore aimed to solidify the value of the MUIIS products and services and to explore and identify business partners, such as farmers’ organisations, agent networks and agribusinesses. The aim is that these entities pay some or all the subscription on behalf of the farmers.

Ensibuukoo was identified as the partner organisation that could best perform the function as business owner. Ensibuuko offers a cloud-based microfinance management platform and data infrastructure called MOBIS with the aim to make the operations of SACCOs and finance providers digital. This includes savings and loans, internet and mobile banking, mobile money (transactions and information per SMS). Ensibuuko partners with a number of banks to do this. They provide intelligence reports on clients to banks. Savings groups are a special type of customers for Ensibuuko. Currently over 100 SACCOs and lenders are served by Ensibuuko.

As a result of the MUIIS G4AW project, insurance is now successfully integrated in the Ensibuuko portfolio. The price of UGX 30,000 (about US$ 8) per acre (about 0.4 hectare) is considered very acceptable. The G4AW support made the inclusion of the insurance part possible and facilitated scaling up.

Impact

The farmers that did receive MUIIS service bundle were generally satisfied by MUIIS services; and reported applying improved farming practices regarding soil fertility and water management, use of improved seeds and fertilisers. These farmers also reported increased yields over the project period and an increased awareness about climate smart agriculture.

Still, the total number of subscribers to the service bundle remained too low to be profitable. By focussing on business-tobusiness contracts and a more limited service portfolio (insurance) Ensibuuko tries to address this issue.

Valuable lessons were learned during project implementation, which include the importance of identifying a business owner from the start, giving sufficient attention to marketing and business sustainability and provision of training at farm level. Challenges related to the operation of the MUIIS system and the services portfolio were also addressed. These concerned the infrequent and late sending of advisory messages and the fact that the provided advisory and weather information was not geographically specific enough. In addition there were some more general constraints, related to absence of mobile network coverage in some areas and difficulties surrounding delivery of the messages in local languages.

The low uptake during the project period notwithstanding, MUIIS succeeded in establishing a strong proof-of-concept, invested heavily in capacity building and provides continued services through Ensibuuko.

| Country | Uganda |

| Services | Crop management adviceAgricultural input loansCrop index insuranceFarmer profile information |

| Crops | MaizeSoybeansBeansSesame |

| Target groups | Farmer (smallholders)Microfinance institute |

| Project period | 2015-2019 |